Tax exemptions in Ghana are a thorny issue. Various governments have granted favorable tax conditions to promote a good investment climate in sub-Saharan Africa for many years.

Whether injecting fresh capital or expanding their businesses, investors have looked forward to exploiting all these opportunities to maximize their returns. The exemptions are typically granted to achieve objectives such as promoting investment and employment in specific industries, sectors, geographic regions, etc.

In the last few years, however, as governments struggle to raise enough revenue to meet their commitments, has reignited debate about the relevance and impact of these exemptions. Historically, compared to its peers in sub-Saharan Africa, Ghana’s tax revenue as a share of its GDP is among the lowest, which opponents of the generous tax exemption regime are quick to cite.

In 2019, Ghana’s President Nana Addo Dankwa Akufo-Addo, in his State of the Nation Address, described as “unsustainable” the rate of exemptions granted to businesses and individuals. Not long after, his finance minister Ken Ofori-Atta submitted a bill to Parliament that will streamline the award of these exemptions.

Three years later, the bill remains with the legislature amidst assurances that it will be passed soon. After the pandemic saw the government’s revenue fall by nearly a third, the economy has been left in a precarious position, with planned expenditure for this year being cut by a similar magnitude.

As far as tax exemptions are concerned, laws like the Value Added Tax, among others, grant certain institutions the permission to give exemptions without recourse to Parliament. On the other hand, the legislature also has the power to grant exemptions to companies or individuals based on certain conditions.

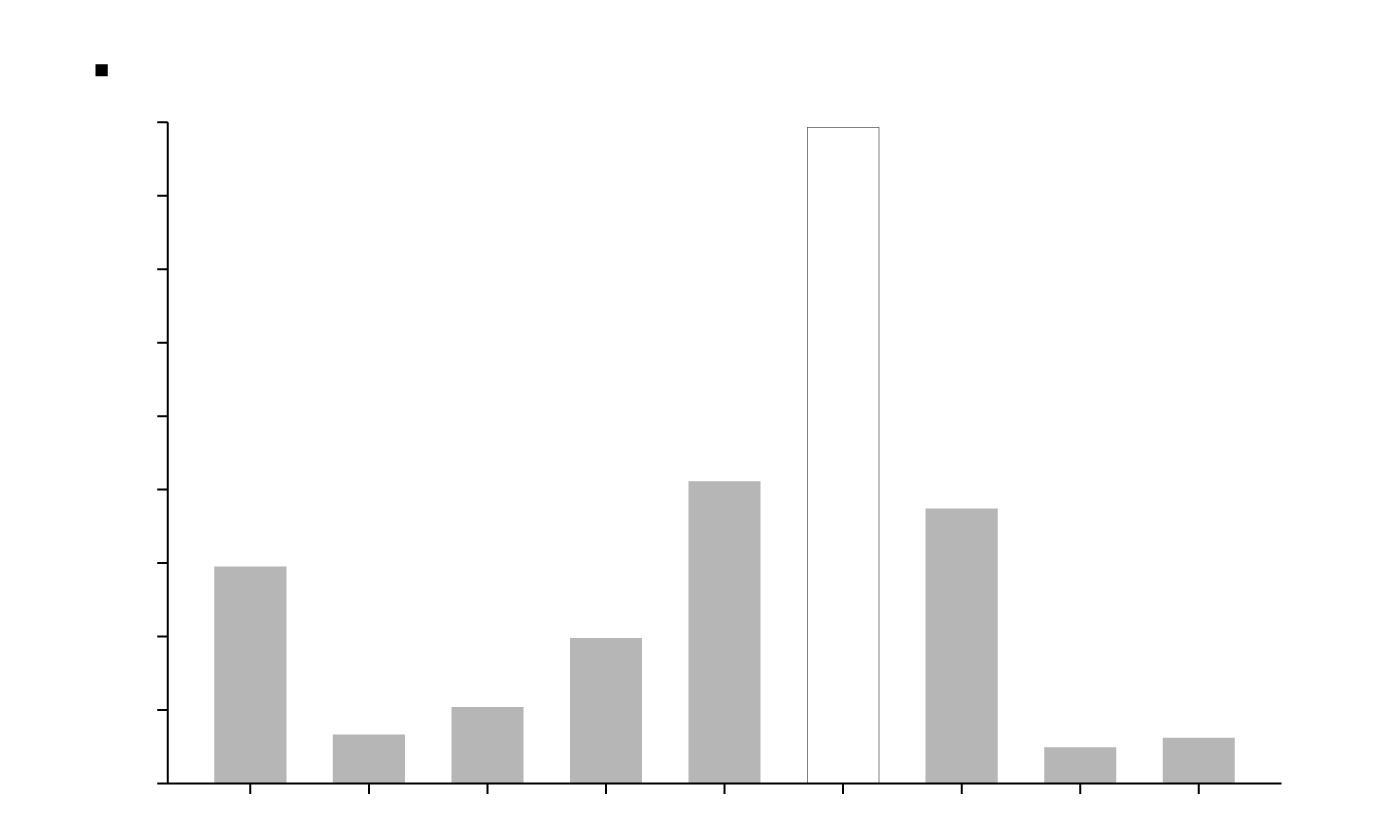

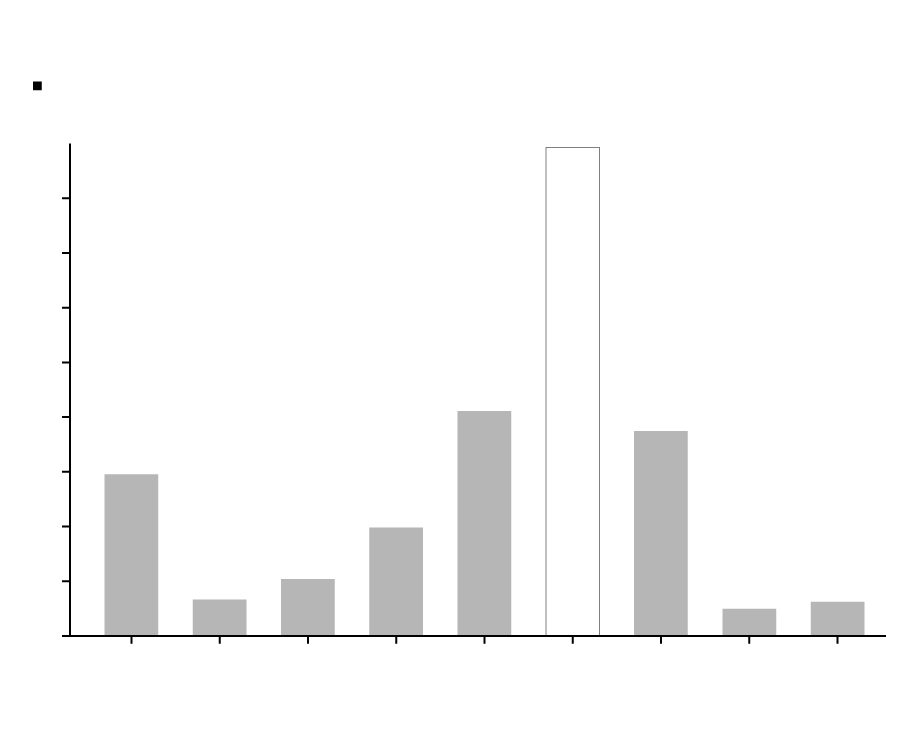

An analysis of exemptions granted by Parliament between 2014 and 2022, the period for which data is available on the Parliament’s website, shows that the government ceded an amount above $US1.4bn for various projects.